Taking on new clients, or opening a new matter for existing clients, can be a complicated process – especially for medium to large size law firms. Internal rules and regulations, conflict checks, local and international obligations, and rules enforced by governments such as Know Your Client (KYC) impose complicated workflows. These obstacles affect everyone from attorneys to various departments and risk management committees. Automating and optimizing NBI procedures is often ignored by law firms since it is not a revenue-generating activity. Even so, streamlining your existing workflow process when taking on a new client and opening new matters provides intangible benefits, such as reducing the administrative burden and managing risk efficiently. This ultimately saves attorneys and members of supporting departments several hours of tedious work when opening a new matter.

So, what do you need to do to maintain an efficient intake process? Review, optimize, and automate. Whether you have an existing intake process or no formal process at all, reviewing, optimizing, and automating the NBI process is essential in today’s digital society. The fundamental concept of the NBI process is to collect enough information about the client or the new matter to reduce the risk of taking on new business. While this may be a universal concept, the implementation can vary from firm to firm depending on factors such as the size of the company, the level of information you want to collect, and regional or international laws that enforce different checkpoints and data. An intake process only works efficiently if it is tailored to your requirements. To build a streamlined NBI process you need to follow these three steps:

Step 1 – Document the Current Process

The first step is to understand the current process in place and document it in as much detail as possible. Observe the current workflow and report major milestones and activities that take place in each step. It is important to understand your current process completely before you begin to optimize, automate, or make any other changes to the process. Documenting the current process should go as follows:

- Define the team members who are involved in the intake process and can help you understand the current procedure and provide input. It is recommended that you form a team that has one representative from each relevant department, as well as a senior attorney and one or two senior assistants to make sure you have key insights for every step of the process. The NBI process spans multiple departments at different stages where information provided by one party is essential for the other parties to proceed.

- Define high-level milestones (aka workflow steps) that need to take place from the time you meet with a potential client until you take the client or open a matter.

- Define what type of information you need to collect in each workflow step. This may include information about the client and the engagement, the information required for opening the matter, financial and legal information regarding the client, information that may be useful for the marketing department, etc.

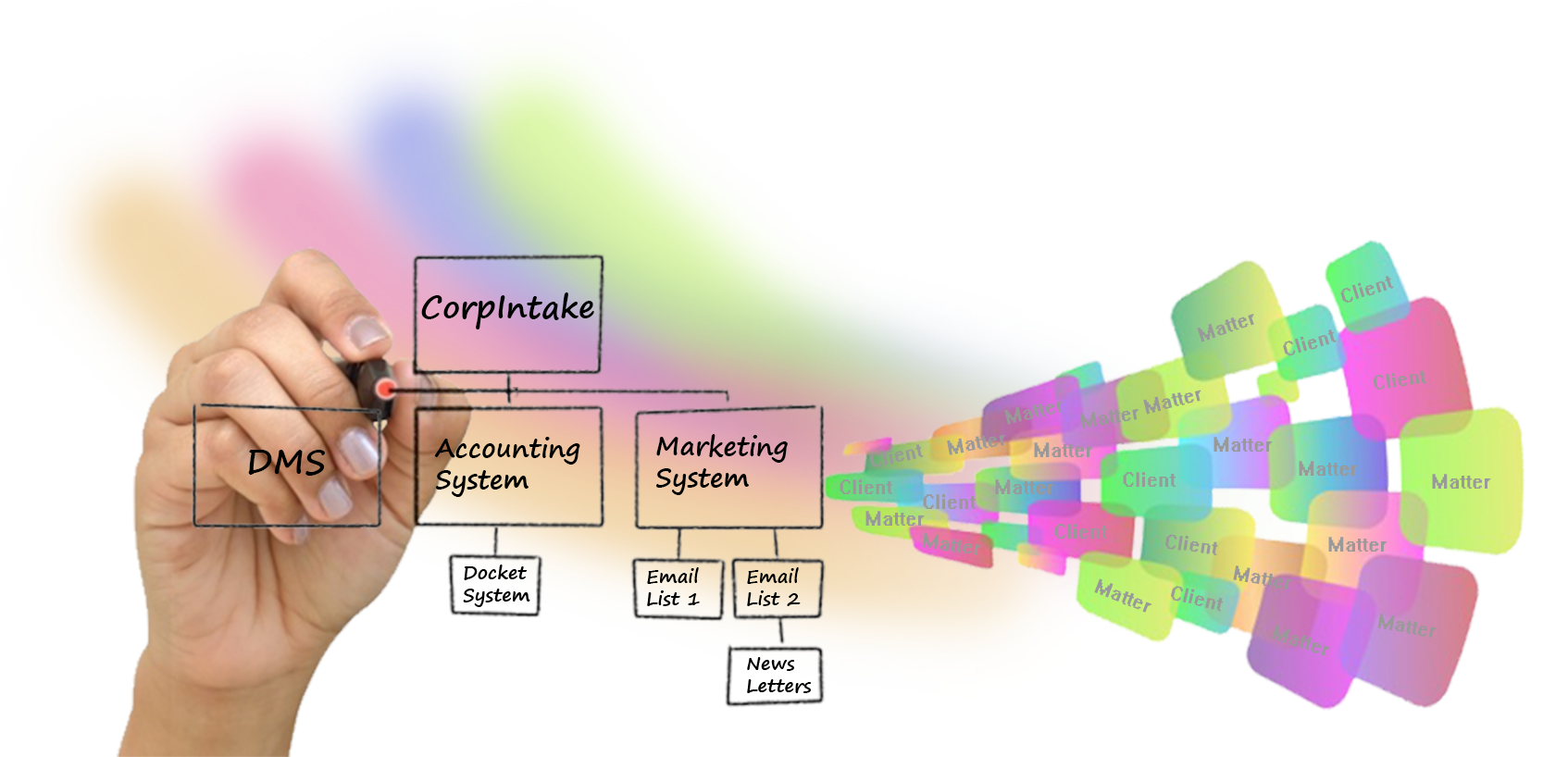

- Usually, the intake process requires the collection of existing information from an internal system such as an accounting system to pre-populate client information. It is also the best place to collect information from users and provide information channels for other systems such as marketing databases, document management tools, and ethical wall systems. It is crucial to identify and document all data points and systems that are involved, and more importantly, the workflow steps where data needs to be presented.

- Define the users (stakeholders) who will be interacting with the system and the level of their interactions. Are they contributors, reviewers, approvers? Define their role, level of access, and the process in which they need to be engaged.

- Define all triggers that initiate communication points (e.g. emails, notifications) and define what type of information needs to be shared with stakeholders.

Step 2 – Review and Optimize

After completing the first step, you should have an outline of how the whole process works and who is involved at every step of the intake process. Using the collected information and the team that has been assembled, you will next review and optimize the process:

- Review and discuss each workflow step to eliminate unnecessary procedures and identify efficient tasks. You can use drawing tools such as Microsoft Visio to map out the workflow diagram to have a holistic view of the whole process.

- Prioritize which information is essential to vetting a client. Often, a substantial amount of additional information is collected from the client that may not be used because the client or matter might not be approved for risk or conflict reasons.

- Identify information that exists in other systems such as accounting software or marketing and HR databases so you can pre-fill the intake forms. This circumvents the process of having attorneys or their assistants fill out intake forms, expediting the intake process and eliminating duplication and user data-entry errors.

Step 3 – Select the Right Tool to Automate

The level of automation that can be applied to your NBI procedure depends on the size of your firm. For medium to large size firms with multiple offices, it is recommended that you utilize an intake system that is easily accessible by users. A web-based application is the best for that reason. Web-based applications also benefit your IT department, as it doesn’t require any software installations, users simply need access to a browser such as Google Chrome.

There are many ways to automate the new business intake process but the following are three major routes that law firms usually take:

- Build it in-house – If you have a large IT department with developers in-house, then this could be an internal project. The benefit of building an intake system internally is that it can be tailored to your exact needs. The time and cost of designing such an application, along with the ongoing support and maintenance, are a few factors to consider.

- Use a financial system with a built-in NBI Process – Enterprise financial systems often have an NBI module built into their system that needs to be configured. The most beneficial part of using a built-in NBI process is that it is already integrated into your financial system. However, setting up, configuring, and customizing a built-in NBI process is not easy. These systems tend to be fairly barebones in terms of functionality. This makes it difficult to modify the built-in system to the exact requirements you have, either because of the lack of functionality, or the manual time needed to implement it properly.

- Third-party NBI applications – Vendors who provide this software are experts in business procedures and workflows. They can deliver consulting services as part of the implementation to help you to optimize and automate the process. If you are going this route, make sure the software you are choosing can integrate into your internal applications such as your financial, marketing, HR systems, etc. Find out how much customization you can do in-house and how much modification can be provided by the vendor. Choosing a third-party NBI is the best choice if cost and employee bandwidth are a concern. Vendors should have a team dedicated to helping you tailor their software to your requirements while providing ongoing support which will ease any burden on your internal departments.

Automating the New Business Intake process is beneficial to any law firm, streamlining the file opening process while resulting in increased productivity, operational efficiency, and better risk management.